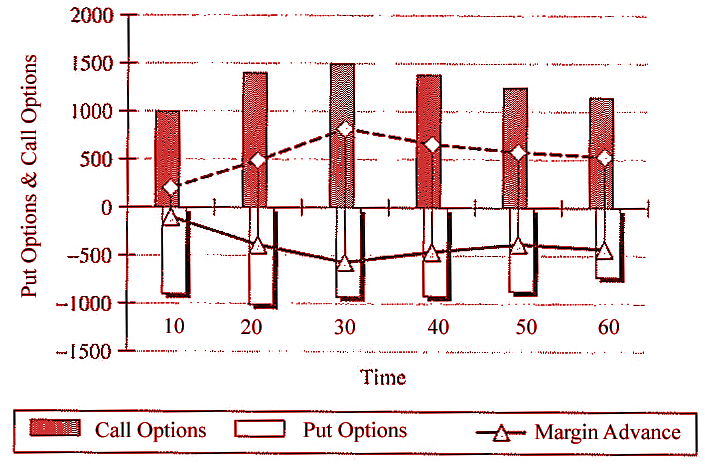

Cryptocurrency-collateralized synthetic currency models securitized by Option Contracts allows the Holder, Buyer, as well as the Writer of a Put or Call in a Digital Cryptocurrency financial instrument to provide the investor an interest free loan or margin advance equal to 10- 100 times the strike price of the Cryptocurrency by the investor paying a premium for the option of the smart contract. In addition to the premium paid for the right to exercise this option the investor allows the writer of the option contract in this case, Allegiant, Inc. our public private cooperative digital investment group the right to hold the underlying cryptocurrency or wallet as security or collateral for this interest free loan to be lent to the investor.

An Option is the right, but not the obligation, to buy (call) or sell (put) at a given price of a given cryptocurrency digital asset at or up to a given date called expiration date. The exercise price is the price to pay the underlying if the holder of the option contractually chooses to exercise it. Exercising the price of a call option is the price to pay if the holder of the option chooses to exercise the contract. The payoff, or liquidation value, of the option is the gain between the strike price and the underlying price, netted from the premium paid. The option value is higher by its “time value” or the value of waiting for better payoffs. A put option is the right, but not the obligation, to sell the underlying cryptocurrency wallet. Options are in the money when the underlying value is below the exercise price. Such options have only time value, since their payoff would be negative. This “time value” is an intrinsic value which inherently prices speculators’ perception of how many times a ratio of a margin advance or interest free loan can be lent to the option buyer or seller by speculating and providing an incentive for the loan. In exchange for the wallet of the cryptocurrency to be collateralized through securitization. It is difficult to give an abstract definition of time, attempts to do so wind up invoking the word “time” itself, or go through linguistic contortions simply by avoiding to do so. Rather than do that we can take a pragmatic viewpoint defined by the investors perception of time which again revolves around “time value” in which “time value” can also be a predictor for the amount of loan provided for the wallets exchange or margin advance. Simply by put the option seller perceiving through projections or inside knowledge that a cryptocurrencies wallet will appreciate substantially more then the debt obligation he loans to the option contract buyer is providing an incentive to the purchaser because his hypothesis leads him or her to believe the appreciation of the digital wallet in his or her possession for this exchange will clearly appreciate in value far more than what is being lent to the purchaser, consequently he or she may offer advances to incentivize a rapid purchase by offering advances on the strike price of the cryptocurrency as much as 10, 20, 30, 40, 50, or 60 times the parity price of the put or call.